Debt is something that affects the vast majority of Americans today. In fact, Comet reports that 80.9% of Baby Boomers, 79.9% of Generation X, and 81.5% of Millennials are currently in debt. That’s a lot of people! The adverse effects of debt can be detrimental – it can greatly harm your physical, mental, spiritual, relational, and of course, financial health. But trying to get out of debt seems like an insurmountable task to most. So what is the best way to pay it off, and how do you get started?

There are two main approaches to paying off debt – the debt snowball and debt avalanche methods. These methods are similar and reliable to help you get out of debt faster and with less interest. But is one better than the other? We will look at the pros and cons of each.

The debt snowball method works by first organizing your debts from smallest to largest balance. This includes your student debt, car loan, any credit card or medical debt, and mortgage. Continue paying the minimum payment for all your debts and then put any and all extra cash towards paying off the debt with the smallest balance. (In order to do this successfully, you’ll need a budget to stick to!)

You continue to make minimum payments on all your debts, but you put any and all extra money towards your smallest payment. Once it’s paid off, you “rollover” what you were paying on that first debt, apply it towards your second debt until it is paid off, and so on, until you are debt-free! It tackles your debt one step at a time. The method is simple and easy to use. Sure, it will require discipline and commitment, but it is definitely worth the effort!

PROS:

The biggest benefit of this method is that you stay motivated and wipe out debts quickly. By starting with the debt with the smallest balance, the hope is that you’ll be able to pay it off quickly and find encouragement and motivation. It also encourages you to stay organized, stick to a budget, and save time and money.

When you use our debt snowball calculator, you can see the amount of money and time you save by using this method.

CONS:

Since you’re paying off your debts from the smallest balance to the largest balance, you’re likely still paying big interest rates on some of those other debts. For example, if you start by paying off a $400 medical bill but have $2,300 in credit card debt, you’ll continue paying higher interest fees on the credit card as you pay off the medical bill.

The debt avalanche method addresses the biggest “con” to the debt snowball method. Instead of working from the smallest balance to the largest, the debt avalanche method tells you to organize your debts by interest rate.

You organize them from highest interest rate to lowest and attack the highest rate debt first. Just like with the debt snowball method, you continue making minimum payments on all your other debts and rollover what you were putting towards the first debt towards the next until they’re all paid off.

This method is strategic and will save you time and money!

PROS:

You save the most money with the debt avalanche method. By knocking out the debts with the highest interest rates first, you’ll save yourself months of steep charges and have more cash to put towards the following debts.

CONS:

This method can take more discipline and commitment since you likely won’t see entire debts eliminated as quickly. You’ll have to keep yourself motivated throughout the process! Keep in mind that if you include your mortgage in your list of debts, you may need to skip it with the debt avalanche method and only continue making the minimum payments.

Both methods are useful and will help you pay off your debt. One is not inherently better than the other, so choosing one for yourself depends on your unique circumstances.

If you know you’ll need the motivation of crossing entire debts off your list, go with the debt snowball method. Furthermore, if you have many debts or lots of different kinds of debts, the debt snowball method will probably be the most helpful for you. For example, if you are carrying balances on 5+ credit cards, have a car loan, and student debt, I’d recommend using the debt snowball method.

However, if you want to apply a little more strategy and can stay motivated on your own, utilize the debt avalanche method. This is especially helpful if you have a few high-interest rate debts, like store credit cards or a cash advance loan.

Choosing to use the debt avalanche method can help you to pay off your accounts with higher interest rates and assist with quickly paying down your debt, which can, in turn, prevent you from accumulating more debt in larger amounts. But not seeing results as fast as with the debt snowball method can be discouraging at times, and not sticking to your plan could have a negative impact on your finances.

Both the debt snowball and debt avalanche methods will help you to achieve the same goal of paying off your debt if done consistently. Figuring out which one works best for you and your financial situation by maintaining a budget, staying organized, and keeping on track can help you pay off your debt efficiently.

If you are married, sit down with your spouse and discuss your financial situation and where you are wanting to be in terms of your short and long-term goals when it comes to debt. Getting on the same page is important, and it can be a crucial factor to make effective decisions regarding your finances.

Pray for direct guidance from God, and ask Him how you should manage your finances. Overcoming debt can be stressful, but the Bible tells us in Philippians 4:6, Do not be anxious about anything, but in every situation, by prayer and petition, with thanksgiving, present your requests to God. By trusting God in everything that we do, we are able to understand that we are not owners of our finances, but managers of what God has entrusted to us. Actively making smarter decisions can make us better stewards of our finances, and this can, in turn, assist us when making decisions on how to pay off debt or anything else that comes our way.

Have you used either of these methods? What are the pros and cons of each in your opinion? Share with us on Facebook or comment below!

Looking ahead to the future is an important, but often scary, thing to do, especially when it comes to your finances. The best way to prepare for the future and give yourself financial margin is to establish a healthy savings account. Not only will it help to ensure that you have cash to cover expenses, but it will help you stay out of debt, reach your goals, and live without stress.

According to Bankrate, about 20% of Americans do not even have a savings account, and out of the ones that do, about a fourth of them are saving less than 5% of their income. Almost the same number save nothing at all! Saving doesn’t come naturally to everyone, but that doesn’t mean you can’t do it.

Sit down and take some time to uncover what your exact financial situation is. Look at your monthly income and budget, see what margin you need to stay within to cover your primary expenses, and then allocate an amount each month to put back into your savings. Cut out the unnecessary things that are preventing you from saving, and form a lifestyle that can equip you with more ways to save. It is also important to make a distinction between money that you want to save and money that you want to invest. Your savings should be liquid, accessible at any time in case of an emergency.

The saying “he who fails to plan is planning to fail” rings true for your finances! Make short- and long-term savings goals and come up with a plan (starting with a budget) on how you’re going to reach them.

Distinguish between emergency savings and big purchase savings. Maintain at least $1,000 in an emergency fund at all times as you work your way up to 9-12 months’ of living expenses. If you want to buy a new car, go on vacation, or put the kids in braces, save for those specific goals. Assign a dollar amount and a time frame to your goal and get to work!

While becoming future-oriented is very important when saving, our plans rarely go exactly how we imagined. Proverbs 16:9 tells us that, The heart of man plans his way, but the Lord establishes his steps. Whether it’s God’s plan or the broken water heater that surprises us, be ready to be flexible. If things do not go exactly how you had imagined when it comes to your finances (or any other aspect of your life), just remember that His divine plan is a part of your journey.

Having goals for your savings can help you to be more intentional with your money and help you to see a present purpose in it rather than only seeing its future potential. It is important to save $1,000 and to keep that money on hand in an Emergency Savings Account that you do not spend unless absolutely necessary. Once this is achieved, try to keep saving until you have 3 to 6 months of your living expenses in this account. The Money Map can help walk you through each of these savings goals, as well as other financial goals.

After these savings goals have been met, you should save for major purchases and begin using those funds to invest. Most people I talk to have a problem because they start investing money BEFORE they have adequate savings. This means when an emergency arises, there is normally a penalty to take money out of your retirement plans.

Think of the horse and cart analogy. The horse comes first. It should be a regular savings habit sufficient to meet these two goals. The cart is the long-term investments that come later. The percentage is up to you so long as you are able to hit these minimum savings targets in a reasonable amount of time. Once you have hit those targets, you can begin to work towards saving the recommended amount of 15% of your total income.

Working on your savings account now rather than later can help bring you closer to your financial goals and even assist with calming financial stress in the future. Take ahold of your savings and maintain a consistent plan that works for you. Though it might seem difficult at first, taking this initiative will help you navigate through your finances and better equip you for whatever the future may hold.

Resumes can be very intimidating and stressful at times. After all, it is usually one of the first opportunities for potential future employers to get to know you. So, how do you decide what to put on this piece of paper to fully represent who you are?

Begin by envisioning what you want your resume to look like. What impression do you want a potential employer to get from simply glancing at the layout? Use this vision to create or choose a template for what best aligns with the impression you want to make.

Most professional positions expect applicants to submit a resume along with a cover letter. This letter must clearly communicate the value you offer a future employer and in a competitive market, and it must stand out from others.

Along with a list of your achievements such as education, work experience, volunteer work, skills, and involvement with outside groups and organizations, you may want to craft a mission statement that reflects who you are and what you want to achieve. This will help paint a compelling picture of yourself to those reading it. Try to focus on pulling out key, influential statements and experiences that demonstrate how your personal efforts influenced and improved an organization.

With this being said, avoid making it a historical document of your life! You don’t need to go back to your first job at a summer camp in high school or list every single project you worked on at your last job. Keep in mind, it needs to fit on one page!

Consider using the “Why, What, and How Formula” from LinkedIn: what you did, how you did it and why. Start with a strong action verb and use quantifiable data. For example: “Created an access database for over 200 clients to achieve a more customized sales approach.” This is your opportunity to share some of your successes in previous roles.

Be accurate and honest in what you write, but don’t shy away from highlighting your successes. God gave you unique skills and talents and employers need to be aware of the value you can bring to their organization.

It’s important to keep your resume current. Update certifications, courses, and professional memberships as you earn or take them. Staying up to date with your resume will save you time and stress when you need it.

Maintaining a portfolio to showcase your talents and abilities is also very important alongside having your resume. This is a place where you are able to keep up with past projects in order to show potential employers to let them get a feel for your skill set and experience.

Remember that your resume is a first impression and reflects who you are. It’s important that as Christians we are marked by integrity, hard work, and humility. As in all areas of our lives, the Bible offers guidance into how we should approach our job search.

Work is a gift from God, and a resume is a tool to get you where you can best serve Him. Learning how to steward our time, money, and experiences is an important part of this process.

Crown’s Career Direct assessment is also a great way to help better understand yourself and your purpose. It looks at your personality, interests, skills, and values in order to help you get to know how God designed you.

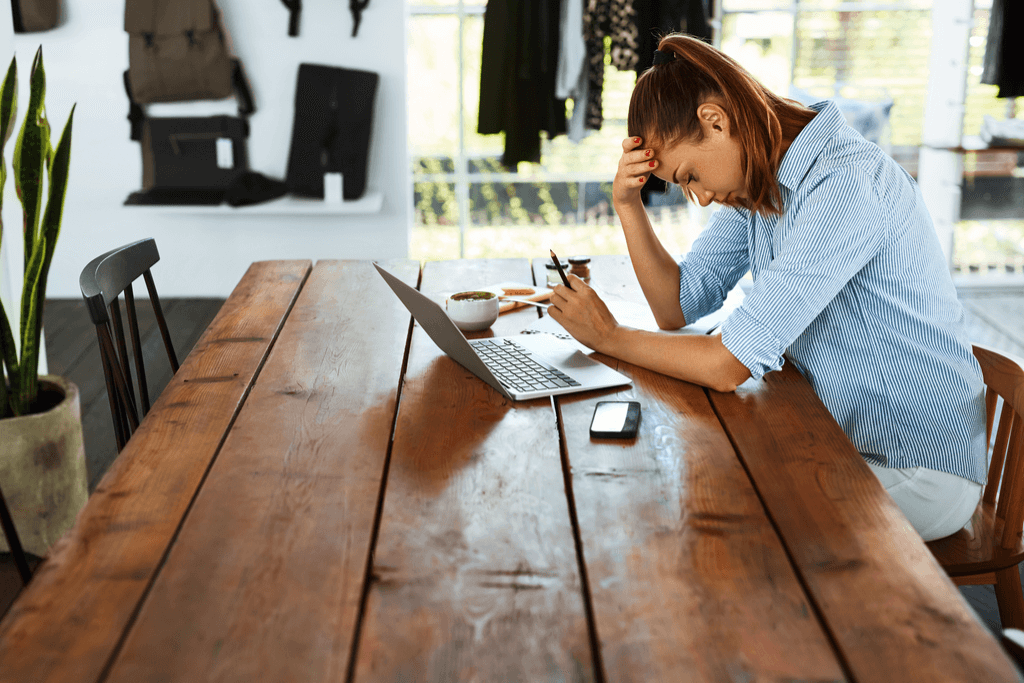

Have you ever felt like a failure? Most of us have experienced that sickening feeling when you realize you’ve missed the mark, made a huge mistake, or gone just a little too far. No wonder fearing failure affects so many of us.

Failure can be an extremely difficult pill to swallow. While it can be viewed as a learning experience, we can become so stricken by a fear of failure that it prevents us from doing things that could potentially have positive outcomes. Sometimes we get so caught up in dwelling on our mistakes that we lose perspective on our past successes and potential future success.

But, God isn’t surprised by our mistakes. In fact, 2 Corinthians 12 tells us that in our weaknesses and mess-ups, He’s made even greater. So don’t give up.

So, what do you do to get over failure?

Repentance is part of learning from your mistakes. Come humbly before God to confess your failures and surrender your future. He’s slow to anger and abounding in love – God can always redeem your mistakes for His purpose. Think about King David; he committed grievous sins, but the Psalms are filled with his praise of the Lord and heartfelt repentance. If you have this attitude, you may be able to avoid messing up in the first place! Psalm 37 tells us, “Commit everything you do to the LORD. Trust him, and he will help you.”

Letting certain failures consume your thoughts can prevent you from moving on and making yourself available for future successes. As humans, we are prone to protect our pride, and failure is one major thing that can hurt this. We must take on an attitude of humility and admit that we are not always going to be right. Once we realize this and accept the fact that life is always going to be filled with both successes and failures, it can become a little easier to overcome the fear of failure and ultimately continue on with life.

If you’re making short- or long-term goals, pray about them and commit them to the Lord. Proverbs 16:19 says, “In their hearts humans plan their course, but the LORD establishes their steps.”

No matter what your failure is, it’s never so bad that God can’t redeem it.

Ask Him to reveal what He wants you to achieve. Trust in His promises and resist the urge to compare yourself to others.

Abide in Him and He will give you the desires of your heart. As John 15 tells us, if we abide in Him, our desires will align with God’s. And when you follow God’s plan you will be successful.

Crown’s online Money Life Personal Finance Study helps you connect with what God’s Word says about your finances, career, and life. This 7-week study is a great way for you to dive deeper into your relationship with God as you transform your finances.

Are you attending any weddings this summer? It’s the height of wedding season right now, which can get expensive quickly.

If you are paying for travel costs, a hotel, possibly a new outfit, and a gift, the cost of attending a wedding can skyrocket. In fact, according to Consumer Affairs, the average American will spend over $700 just to attend a wedding. That price is likely to increase if you’re in the wedding or a Millennial.

So how do you still make an effort to give thoughtful and useful gifts without ruining your own budget in the process? We’ve compiled some of our favorite wedding (and shower) gifts that are under $30, as well as some “gift hacks” to help you make it through the summer.

Your Time or Services. If you have great handwriting, offer to hand letter the ever-present chalkboard signs, or address invitations. You can also bargain hunt for the chalkboards or signs at consignment stores, used wedding supply stores, Goodwill, Walmart, or Hobby Lobby. If you’re talented with graphic design, offer to design and print the wedding programs free of charge. If you’re a musician, offer to play for the wedding. If you’re extremely organized, offer to help with making a timeline or a seating chart. If you’re good at doing hair or makeup, offer to do the bride’s and/or bridesmaids’ free of charge. If there will be a lot of guests coming in from out of town, offer to house the bridal party or family in your home. Host a brunch for the bridal party a few days before the wedding.

Home Essentials Kit. These work best if the bride and groom are moving into an apartment or home that one of them has not previously inhabited. Put together some practical home items in a cute basket or trash can, or get really creative and make them a housewarming “cake”.

Sentimental Touches. Take an extra wedding invitation and put it in a nice frame, or cut it into small strips to put in a pretty Christmas ornament like this. Little details from the big day are easy to forget and they’ll appreciate having them to remember later on. Write letters from you and your spouse for the bride and groom to open on different anniversaries (1 month, 3 months, 6 months, etc.) throughout the next year. Include encouragement, Bible verses, and wisdom that other couples have shared with you.

Stamps. The bride and groom are going to have a lot of thank-you notes to write and buying all the stamps can be expensive. For an extra touch, have the stamps personalized without spending more than $25.

Family Recipe Cookbook. Collect recipes from both sides of the family and compile them in a sweet cookbook for the couple. Try to have everyone write the recipe in their own handwriting and include a note, verse, or piece of encouragement for the couple. Put them together in a photo album or binder – and be sure to leave some blank pages for the bride and groom to add their own recipes!

Kitchen Items + Recipes. Give one of your favorite recipes with the kitchen item that goes along with it. For example, buy the couple a waffle maker and include your famous waffle recipe. (Try to pick an item off their registry to be sure they’ll put it to use, but add the personal touch of a beloved recipe.)

Get Well Kit. There is often stress involved in planning a wedding, which means immune systems are weakened and can crash after the big day. A Get Well Kit like this one comes in handy at any time, but especially post-wedding!

Perfect Pairs Kit. Get creative and put together a “Perfect “Pairs” kit like this one to add some personality to everyday items.

Gift Cards.Pay for a date night by giving them a gift card to a restaurant or movie theater. A gift card to Lowes or Home Depot will also come in handy!

Monogrammed Items.Things like coasters, towels, napkins, placemats, cutting boards, and blankets are all home essentials that are made a little more special with some personalization.

Bonus! This is your extra gift idea – the online MoneyLife Personal Finance Study. Navigating finances as a newlywed can be both stressful and overwhelming! Give the new couple a head start by blessing them with Crown’s online study. It’s completely self-paced so they can start and finish whenever they want and it will help them establish their plan for a biblical financial future together.

We hope that your summer is filled with quality time spent with friends and family! What are you doing this summer? Share your budget-friendly vacations, activities, and gifts with us!

Saving is biblical; God wants us to be savers! He wants us to have the resources we need to take care of our families and others. He also wants us to be in a position to serve Him so that He will be made known and honored. Saving does not represent a lack of faith, but it does reflect the heart of a faithful steward.

But finding extra margin in our finances to save can be challenging! Especially if you are trying to pay off debt, are living paycheck to paycheck, or have recently gone through a major life change. These 13 money-saving hacks will help you save money you may not have known was there before.

If you are paid biweekly, you actually receive 26 paychecks a year instead of 24. Instead of budgeting based on those 26 paychecks, budget based off getting paid twice a month – 24 times – instead. Then you’ll be able to save your extra two paychecks!

Sometimes you can be your best source of motivation! Challenge yourself (or your spouse or a friend) to spend $3 less per meal every time you go out to eat. Try instituting a leftover night once a week, having “no spend” days, or competing to see who can spend the least amount of money per week.

This is one of the best savings hacks out there. Automating a certain amount to go straight from your paycheck to your savings account will help you reach your goals quickly. The old adage, “out of sight, out of mind” is the driving principle behind this. If you can’t see the money to spend in the first place, then you won’t be tempted to spend it!

Did you get a refund check this year? While it may feel like you get a bonus from the government every Spring, they’re actually just returning your own money to you. They borrowed it interest-free for the last year and then you have to ask for it back!

Instead, adjust your withholdings so you have that extra money in your account every month. However, you will need to plan in case you owe the government money come Tax Day!

Apps and browser extensions make it easy to shop with coupons and earn money back from rebates. Download apps like RetailMeNot, and Ibotta. Install extensions like Honey so you never miss a deal when online shopping.

Take an extra five minutes in the store to scan all your items and check for coupons or rebates. Even better, check for coupons and apps before shopping so you can buy based on what the best deal is. It may be small savings, but they accumulate over time!

A lack of planning is a major spending trap. Before you go shopping anywhere – the grocery store, Walmart, the mall – make a list. Then stick to it! This is where that competitive spirit can come in handy – see how quickly you can get everything on the list and try to come in under budget. You should know about how much you’ll spend before you walk in the store.

New technology and services like grocery pick up services have made this savings strategy convenient for a small fee. Look into your local options and consider if they could help you save!

It may be uncomfortable if you’re not a natural bargainer, but it’s always worth it to ask for a discount. Try this especially with your cable and internet provider once a year. Ask about loyalty discounts, sales, or other offers they have going on.

There is strength in numbers, especially when it comes to saving! A group of my friends always shares when they find good sales, and will sometimes pick up items for one another to take advantage of the sale. Look online, in circulars, and ask around for the best prices.

Before you purchase a big item, spend time researching to see if you can find a better deal. If you find a better price non-locally, ask for a price match. A few minutes online can save you lots!

One of the Crown staff members has most of her Christmas shopping done by September. She finds and purchases gifts for members of her family throughout the year when she finds a good sale. By doing so, she avoids the stress and markups of the Christmas season and can actually relax and enjoy the holidays!

Goals will motivate you to keep saving. Proverbs 29:18 says, Where there is no vision, the people perish. If you don’t have a vision for your savings, you won’t make any progress. Decide on a realistic amount of money to have saved by a certain date and then align your budget to reach that goal.

Every time you reach a goal, celebrate, make another, and keep going. You should always have short-term and long-term goals!

We are big advocates of an all- (or mostly-) cash budget. If you use cash for all of or some of your budgeting categories, commit to saving every $5 bill you touch.

One woman did this for 12 years and saved $37,000! Proverbs 21:5 says, Steady plodding brings prosperity. Start plodding!

This may sound impossible to some, but switching to only water can save you hundreds, if not thousands, of dollars a year. A latte out costs around $5. A soft drink or tea at a restaurant costs around $2. If you have one coffee and one tea or soda out every day, by switching to water, you’ll save around $2,550 a year. And it’s significantly better for your health!

Hopefully, these 13 things give you some ideas to get started on your savings goals! We recommend you start by saving $1,000 in an emergency fund. You can find 13 more tips on how to do that here. Once you have $1,000 in an emergency savings account, work your way up to 12 months’ of living expenses. The Money Map can help you set and track financial goals like these. Download it for free here!

We know comparison isn’t godly, yet it’s so difficult to avoid. It seems like it’s gotten more out of control with the rise of social media and our constant exposure to ads and TV. It’s gone far beyond a friendly rival with your neighbor; in fact “keeping up with the Joneses” sounds kind of like an idyllic relic of simpler times. Because comparison has started to creep into every area of our lives. It divides, disillusions, and can destroy.

So what does the Bible say about comparison? How do we prevent it?

The only true antidote to comparison is contentment, which begins with a thankful heart. The comparison trap compels us to turn inward, to focus on ourselves, what we lack, what caused our discontentment. Thankfulness, on the other hand, compels us to turn our attention to others. It’s like a salve over a fragile or damaged heart. When we are thankful, we don’t see what we lack. Instead, we see the generosity and faithfulness of a good Father and are compelled to meet the needs of others.

2 Corinthians 5:14 – For Christ’s love compels us, because we are convinced that one died for all, and therefore all died. And he died for all, that those who live should no longer live for themselves but for him who died for them and was raised again. So from now on we regard no one from a worldly point of view. Though we once regarded Christ in this way, we do so no longer.

Just like we have to discipline our hands to save and give regularly, we also need to discipline our eyes to look upon what truly matters. The things of eternal value cannot be found on Pinterest, or Instagram, or Facebook.

When you face the temptation of the comparison trap, it’s important to have the Word of God hidden in your heart to combat it.

Remember the words of the Apostle Paul, “At one time you were darkness, but now you are light in the Lord. Walk as children of light for the fruit of light is found in all that is good and right and true.” (Ephesians 5:8-10)

You’re to “Do nothing from selfish ambition or conceit, but in humility count others more significant than ourselves.” (Philippians 2:3)

You’re called to remain “steadfast, immovable, always abounding in the work of the Lord….knowing that in the Lord our labor is not in vain.” (1 Corinthians 15:58)

You’re not to “become conceited, provoking one another, envying one another.” (Galatians 5:26)

Instead of checking Instagram, “Delight yourselves in the Lord,” knowing “he will give you the desires of your heart.” (Psalm 37:4)

There have been numerous studies done to show the positive effects serving has on our overall physical and mental health. The best thing you can do to cure yourself or someone else of the comparison trap is to consistently serve others.

There’s a reason serving has such a positive effect on our behavior – because it influences our beliefs. It helps us to take our minds off ourselves and focus on meeting the needs of others.

Look at the words of Jesus in Matthew 20: “…whoever wants to become great among you must be your servant, and whoever wants to be first must be your slave—just as the Son of Man did not come to be served, but to serve, and to give his life as a ransom for many.”

If you’re struggling with comparison, be intentional to spend time serving others. There are needs all around you – start praying about which ones God wants you to meet first.

For 21 years of my marriage, my wife and I were in disagreement about money. I was content pursuing all the riches this world offered, tithing 2.6% of my income, and not involving God in any of my financial decisions. She wasn’t.

The turning point in our marriage came when she lovingly convinced me to join a Crown Bible study. Talking about my marriage and finances in a group sounded like just about the worst thing I could think of, but I went. And God started to change my heart.

One day, my wife gently asked me, “Do you agree with God’s teaching on money?” I said, “Yes. I agree with God.” She then said, “Good! If you agree with God, then I can agree with you!”

We quit competing about our preferences and started unifying under God’s plan. Here are 7 keys that we have found to handling money in our marriage. These are the core of what God taught us through our 38 years of marriage.

If you want to experience healing, be the first to confess, and the first to say, “I’m sorry!”

Pray for peace in your marriage, and actively choose to be the peacemaker. If one of you is a peacemaker, your marriage will survive. If both of you commit to becoming peacemakers, then your marriage will thrive!

God’s plan for our prosperity includes marriage. It is not in spite of marriage. Of course, God can bless those who don’t marry. But you and I should see our spouse and family as a key part of living a prosperous life. Read God’s plan for prosperity in Jeremiah 29:4-11.

Most individuals, myself included, know that they want to get married and have kids, but can’t really explain the purpose of doing so. Let me encourage you – God has a very specific purpose for your life and marriage. Regardless of your occupation, income, or social standing, God has called you and your spouse to give your utmost for His highest glory.

Whether or not you know it, both you and your spouse have a philosophy about money. You form it through your life experiences, preferences, thoughts, and personalities. Your personal philosophy is bound to be different from your spouse’s and can cause frustration and disunity. But God’s transformational power provides an advantage for two to become one regardless of your personalities, background, or annoying habits. Develop a Biblical philosophy of money with your spouse!

Remember that you and your spouse are on the same team. And on any team, you have to use your teammate’s strengths to help you win. Especially if their strengths happen to be your weaknesses. Don’t try and change your spouse to think and feel the same way you do. Use each other’s strengths and differences to attack your financial challenges together.

I think the first step you should take towards making a plan involves a budget. You can download an easy-to-use guide to making one that you and your spouse can agree upon here.

The plan you develop won’t just help your finances, but will help you to fulfill the purpose God has for your life and marriage, will be aligned with Scripture, and will lead you to achieve your financial goals.

Now that you’re working on a plan for success, you need a process to keep your plan moving forward, even when a setback occurs.

I’ve found it’s helpful for couples to put themselves either in charge of offense (earning income) or defense (keeping a budget, paying the bills). It will take both your efforts to make a comprehensive process and in some cases one spouse may be more gifted at both the offense and defense. You still need to find an effective process that works for your marriage.

If you want to learn more about our experience getting on the same page about money, and go into more detail on each of these 7 keys, get a copy of our book, Money Problems, Marriage Solutions.

Learning how to budget can be challenging! For some people, it comes naturally, but for others, it takes an extra dose of discipline to develop the habit. But knowing how to budget when you have inconsistent income can be especially challenging.

An increasing number of professionals are working for themselves, creating their own businesses, and joining the “Gig Economy”. According to a 2017 report from Intuit, the contingent workforce or non-traditional segment makes up 36% of the U.S. workforce today, compared to 17% just 25 years ago. Gig workers, also known as on-demand workers, are part of that group.

Planning is a necessary part of financial health for everyone, but especially the freelancer or commission-based employee. You have more flexibility than traditional workers, but you also have different challenges brought about by the uncertainty of your income.

The best example of a great budget on an inconsistent income is found in Genesis 41-47. God had warned Pharaoh through Joseph that 7 years of harvest were coming to the land of Egypt, followed by 7 years of famine. So Joseph advised Pharaoh to be diligent to save 20% in the years of plenty. This savings plan enabled the entire country of Egypt and surrounding countries to be fed during the severe famine.

If Pharaoh had not enabled Joseph to put a plan in place during the plentiful years, the years of famine would have wiped out entire nations. It may be difficult, but you can have a great budget on an inconsistent income!

Here are 4 steps to create a budget on an inconsistent income.

There are two main ways to estimate your monthly income with a variable income. Look at the examples below.

| January | $5,175 |

| February | $5,233 |

| March | $4,798 |

| April | $5,129 |

| May | $4,763 |

| June | $3,198 |

| July | $3,004 |

| August | $4,511 |

| September | $5,097 |

| October | $4,970 |

| November | $5,995 |

| December | $5,897 |

Option 1: Base your monthly income on the lowest month you had in the past 12-18 months. In this example, that would be $3,004. During the months that you make extra, put it aside in savings or use it to attack any debt you have.

Option 2: Base your monthly income on an average of the last 12-18 months, after you throw out the month you earned the most. In this example, you’d throw out the month of November, and average the remaining 11 months to give you a monthly total of $4,706.

With either option, your monthly income is lower than your highest months of earnings. So you should always have financial margin to save and work towards your goals.

Like Joseph, we should all be in the habit of saving extra in the years (or months) of plenty to prepare for the times of famine.

More than traditional workers, freelancers need to have a running total of their fixed monthly living expenses: this includes mortgage/rent, insurance, etc. Then add your monthly variable expenses – things like groceries, utilities, taxes, and tithe. These are your monthly living expenses.

Once that number is set, add in the “extras” – buying new clothes, entertainment costs, etc. Crown has a helpful worksheet that you can utilize to keep up with all your monthly expenses.

Once you have your monthly expenses set, keep track of how much you’re spending for several months. No two months are exactly the same so keep track of how much you’re spending. Record your expenses by writing them down in a worksheet (this one is already set up for you) or connecting a budgeting app to your bank account.

In order to be successful on an inconsistent income, you’ll have to be disciplined to keep your lifestyle at a reasonable level. It’s easy to get into a cycle of depending on your credit cards during your lower income months and then paying them off during your high-income months.

But this will keep you in a perpetual cycle of debt and bondage, which is contrary to what God encourages in Scripture. Instead, be content to live beneath your means all the time.

You’ll need to develop the habit of saving. Set up monthly automatic transfers and manually transfer excess in the high earning months. Establish an emergency fund with $1,000 to help you get out of debt, stay out of debt, and cover emergency expenses without a credit card.

Then work toward saving 3-6 months’ of your living expenses. Try to ultimately have 12 months’ of living expenses set aside in a savings account, separate from your $1,000 emergency savings fund. This is your safety net for lower income months to cover unexpected medical bills, home and vehicle repairs, and other surprise expenses.

One of the downsides of “gig work” is the lack of employer-provided benefits. This means it is solely up to you to plan and save for your future. This blog outlines many retirement savings options for freelancers and gig workers.

It may take you 6-12 months to get on track, so be disciplined and exercise self-control. Depending on your current lifestyle, you may need to make adjustments so you can save when extra income comes in. By living according to God’s principles, you’ll be able to experience true peace.

How have you made a great budget on inconsistent income? Share your advice and tips with us on Facebook!

Teaching your kids about money is a challenge and often an overlooked part of the training they desperately need!

Children, toddlers especially, aren’t ashamed of their selfishness. They’re completely inwardly focused, only concerned about themselves. That’s why a room full of 2-year olds is full of “me, my, mine!” and why sharing has to be taught.

While we may get a little more discreet or tactful in our outward expression of selfishness as we get older, much of the time, the heart attitude remains the same as a child, thinking only of ourselves.

So how do we teach our own children to be good stewards as we ourselves are trying to become one?

Well, it all comes down to being intentional about the key lessons to pass on to our children. Here are the ones I think should be your priority.

The Bible makes it clear that we are not the owners of anything. God wants us to recognize that we are managers, not owners, of all we have. He has entrusted resources, relationships, time, and money to us, and He desires that we are faithful in the way we manage them in order to please Him. That means we need to know and apply His principles of financial management.

Have you ever heard the saying, the biggest lessons in life are generally caught, not taught? Resolve to live as a steward, and your children will inevitably learn how to do the same. It will take intentional conversations and lessons, but they’ll grow up knowing what a steward looks like.

Work is good! It was always part of God’s plan for man to work – He gave Adam charge over the garden before the fall of man. Help your children understand that we were created to work and that it is a blessing. It is a practical way to help them discover the skills and talents God has given them. Excellence and diligence combined with humility will equip your child to become salt and light in their workplace.

Give them “jobs” now – chores around the house that will teach them responsibility. Try having two categories of responsibilities – every day, unpaid expectations, and special paid job opportunities.

Come home thankful for your job every day. Talk to your kids about the blessing of earning an income and working to provide for them. Even on the frustrating days, be disciplined to thank God for your job and teach your children to do the same.

This is the best way to protect your child from becoming materialistic. Generosity will bring your child priceless joy and prepare them for supporting God’s work in their generation.

Help them set up a plan for giving their first 10% as part of their budget. They can also develop a generosity fund for giving above and beyond a regular tithe. Generosity may or may not come easily for your child – focus on the principles that will best teach your child God’s intent for generosity.

Remind them that generosity isn’t always about money. They can be generous with their time, their kindness, and their talents as well. Be sure to show your children that you don’t have to have a lot of money in order to be generous.

Don’t forget to demonstrate generosity. Remember they learn more from watching how you behave than by listening to your words. Bring them with you as you give generously of your time and demonstrate how to serve others. Let them see the family budget and be involved in the giving decisions.

Delayed gratification is possibly the best lesson your children can learn when it comes to wise money management. Once they have given their first 10% of their chore earnings, teach them to save 50%.

Talk to them about the difference between saving money and hoarding it. Read Matthew 6:19-21 with them and explain what treasures in heaven mean. Not only will this get them in a great habit, but it will build their savings from a young age. If they want a new game or app, make them wait to purchase it until they have enough money to pay cash for it. You’ll instill in them a great work ethic and discipline to avoid debt.

The remaining 40% of their chore earnings are for them to spend….wisely. Talk to your child about the importance of tracking their spending and following a budget. Warn them of the dangers and traps of using credit cards, and openly talk to them about the sacrifices you make to stay on track. Call out phony ads or manipulative sales to help them navigate scenarios in the real world. Teach them the difference between frivolous spending and careful, wise purchasing habits.

Remind them to do everything with excellence, diligence, and humility.

Get the conversation about money started with Raising Money-Wise Kids. It’s full of practical ways for you to teach your kids biblical principles with stories and activities. They’ll love it and it takes pressure off of you!