What’s the most difficult category to stick to in your budget? Food? Entertainment? Miscellaneous items?

We all struggle with different kinds of budget busters. Kind of like budgetary “kryptonite”, they’re things that we just push the limit on month to month.

In a recent study from Varo Money, they defined these expenses as “guilty pleasures” and asked Americans which get the majority of their money.

Overall, 87% of Americans admitted to spending money on guilty pleasures. These are the top 5:

The top four of these five are also what Americans would like to spend less money on in the coming year. In essence, Americans are saying, “yes I know I overspend. Yes, these are the things I tend to overspend on. And yes, I’d like to stop overspending on them.”

Can you identify?

Of course, the only way to keep from overspending is to limit your spending all around. Your overall expenses must be less than your income in order to stay on a healthy budget. So arguably, you’d have to give up or slim down on at least one of your “guilty pleasures” in order to correct your budget.

Out of all the guilty pleasures listed, Americans wanted to keep one: streaming services. Only 7% of those surveyed said that they planned to spend less on streaming services in 2018.

I think this is a fascinating find, given the consumer migration from “all-in-one cable” to “a la carte streaming services” in recent years. It’s also interesting given it’s the only entertainment-centered expense on the list. Americans say they’re willing to give up their Chipotle, Amazon, Uber Eats, and Free People, but not their Netflix.

In today’s “plugged in” culture, I’m not sure this is good news. Our relationships with our phones, tablets, computers, and TV’s has gotten out of control. And in many ways, is keeping us from stewarding our time the way God wants us to.

God cares greatly about both our time and our money:

Psalm 90:12 – Teach us to number our days, that we may gain a heart of wisdom.

Colossians 4:5-6 – Be wise in the way you act toward outsiders; make the most of every opportunity. Let your conversation be always full of grace, seasoned with salt, so that you may know how to answer everyone.

Psalm 24:1 – The earth is the LORD’s, and everything in it, the world, and all who live in it…

Proverbs 23:4-5 – Do not wear yourself out to get rich; do not trust your own cleverness. Cast but a glance at riches, and they are gone, for they will surely sprout wings and fly off to the sky like an eagle.

When we surrender both our time and money to His lordship, we live with more peace, freedom, and joy in our lives. But it takes self-control, a faithful heart, and disciplined hands to get there.

So when it comes to your guilty spending pleasures, use it as an opportunity to exercise your self-control. Ask God to give you a faithful heart. And see the fruit of your disciplined hands by sticking to your budget and saying “no” to the things that don’t matter in eternity.

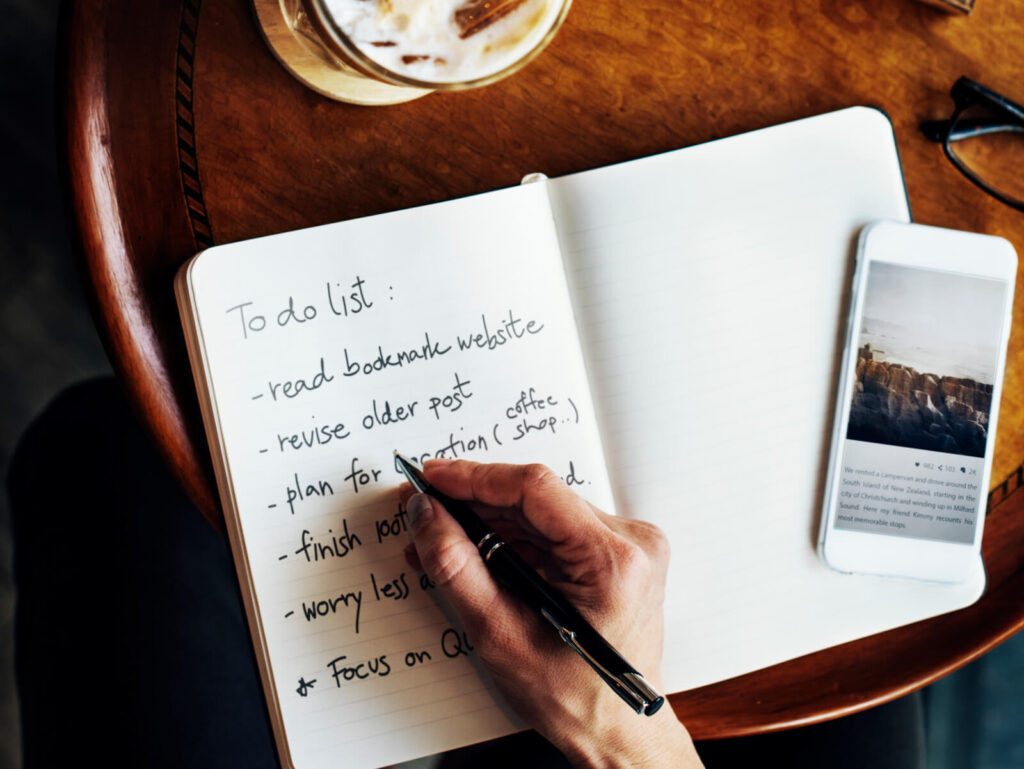

The first step is to have a budget that works for you! Crown has an easy-to-use guide that walks you through the process so it’s neither overwhelming nor intimidating. Whether you use an app, a spreadsheet, or a notebook to budget, the Easy Guide to a Budget You Love can help!

I did not enjoy taking tests in school. There were some students that eagerly welcomed the opportunity to showcase their knowledge, but tests typically made me nervous.

As a student, I saw a test as a way to prove to the teacher what I had learned. The number of correct and incorrect answers I gave would indicate to my teacher what I had or hadn’t retained over the course of the week, quarter, or semester.

But as I’ve gotten older, I’ve realized something else about tests. That truly, tests tell me what I know or don’t know. Yes, how I perform on a test earned me a certain grade and showed my teacher what I did and didn’t know. But they also show me what I do and don’t know, and in most ways were more telling to my own person than they are to the person administering the test.

Life is a series of tests. In school, our tests involve a pencil and paper – maybe a scantron, a calculator, multiple choice options, or essay questions – but in life, they’re much more abstract. Life’s tests are emotional, difficult, humbling, spiritual. We don’t have a teacher handing out the tests, grading us, and telling us what to fix next time. Almost all of life’s tests are meant to show us something.

And, one of the greatest tests we’ll ever face involves the love of money.

Jesus tells a parable about a rich young ruler in Matthew 19. This young man sincerely wanted to know how to attain eternal life. But, “Jesus, looking at him, loved him and said, ‘You lack one thing: go, sell all that you have and give to the poor, and you will have treasure in heaven; and come, follow me.’ Disheartened by the saying, he went away sorrowful, for he had great possessions.”

In this parable, Jesus is giving the man a test, not so He can pass or fail him, but to indicate to the man what is in his own heart. Often we don’t know the true condition of our heart until it is tested. Perhaps this is why we struggle with money so much – we think we are disciplined to stay on a budget, aren’t materialistic, and prioritize giving. But when any of those are truly tested, strained, challenged, we surprise ourselves with our reaction. The true condition of our heart isn’t what we thought.

I have always said that the quickest way to know if you love something or not is by the way you react when you lose it! That is a very revealing test.

This rich young man thought he was doing everything right. Arguably, he had all the right answers. But when Jesus identified the hold his possessions had of his heart, the rich young man didn’t want to give them up. His fear of losing his possessions and power clearly indicated what he truly loved.

What about you? Do money and possessions have a hold of your heart? Have you adopted a worldly philosophy – running after affluence and worldly success instead of faithful stewardship? Or seeking security in your savings? What might He be asking you to surrender, to let go of as a test of what is in your heart?

Paul told Timothy, “…the love of money is a root of all kinds of evils. It is through this craving that some have wandered away from the faith and pierced themselves with many pangs.”

Money isn’t the problem. The love of money is. Stewardship is not having a perfect credit score, or a maxed out 401(k), or an air-tight budget. Those things may be indicators of faithful stewardship, but that’s not what God is after. He is after our hearts.

First Samuel 16:7 says, “The LORD does not look at the things people look at. People look at the outward appearance, but the LORD looks at the heart.”

Stewardship is aligning your heart and money with God. A steward surrenders all to God, rejects the love of money, and chooses instead to live according to God’s plan. It’s a heart and mindset shift, where you recognize that you’re only a manager, not an owner, of all you have.

God knows our hearts. He tests them and shows us what’s there. So to pass the money test, be sure your heart finds its riches in Christ, not in this world.

To take the practical first steps, enroll in Crown’s online MoneyLife Personal Finance Study. You can take an in-depth look at what the Bible says about all aspects of your finances and what it means to be a steward.

Have you ever lied to your spouse about a purchase or hidden money? A poll from the National Endowment for Financial Education found that 2 in 5 Americans admit to lying about or withholding money information from their partner. USA Today reports that 15 million people have admitted to hiding financial information from their spouse, and 9 million used to but don’t anymore. Why is financial infidelity so common?

Just like any other form of unfaithfulness, financial infidelity occurs when one (or both) partners hide (or misconstrue) financial information from the other – such as past debts, spending habits, or other bank accounts.

This is a growing problem. The National Endowment for Financial Education states that financial infidelity can be just as significant as emotional or sexual infidelity in marriage. And Financial Family law attorney Steven Mindel says, “More marriages fall apart for financial reasons than for fidelity reasons…marriages are built on trust and anytime you breach the trust of the other party, it damages the relationship. Getting married is like the merging of two enterprises.”

Often times a spouse may lie to avoid conflict or ignore financial problems. Sometimes the truth is not told because one spouse had no confidence in the other.

Maybe a husband or wife thought they shouldn’t burden the other with the truth from their financial history and was trying to take care of it on their own. Many women take misguided advice and open their own secret checking account “just in case”.

People who are keeping secrets about their finances usually aren’t trying to hide criminal activity or an affair or have malicious intent…they’re just embarrassed. Sometimes admitting you have a problem and feel embarrassed is more difficult than admitting you messed up.

Even though the intent is usually not to harm the other, the truth will eventually come out and the results can be painful. Someone is hurt, loses respect and trust for the other and wonders what else may be hidden. The entire marriage relationship may be questioned because trust is lost.

If you’re suspicious, don’t stress. Go to the Lord. Ask Him to give you discernment and peace. Then, approach your spouse with humility and love. Don’t catch him or her off guard.

If you’ve started noticing some red flags (you found a receipt for an unfamiliar purchase, an unexplained charge on the credit card, or are unable to locate a bill or credit card statement), stop and pray. Before you ask your spouse about it, ask the Lord to give you the right words to say and to prepare your spouse’s heart to answer with the truth.

If your spouse gets defensive or withdrawn when asked about it, don’t lose your patience. Stay calm and don’t get flustered or incessant. Proverbs 3:3-4 says, Do not let kindness and truth leave you; bind them around your neck, write them on the tablet of your heart. So you will find favor and good repute in the sight of God and man.

If you need to confess to your spouse, pick an appropriate time and share your desire to get on the same page. Be fully honest and transparent. Apologize for anything you’ve done and be the first to forgive.

Recognize that there may be extra work that needs to be done to repair both your finances and trust. Reach out to a trustworthy pastor, mentor, or counselor for help.

Solomon said, “Better is a poor person who walks in his integrity than one who is crooked in speech and is a fool.”

Then, create goals to plan for your future. Trust must be rebuilt so learn how to better communicate about finances. Hold each other accountable and find ways to celebrate your improved relationship and bank accounts.

Proverbs 10:9, He who walks in integrity walks securely, but he who perverts his ways will be found out. It may take a hard conversation, but I’m challenging you today to sit down and be honest with your spouse about your money.

Trust is a currency of greater value than any amount of money. And, it’s foundational in marriage.

Paul said in Colossians 3:9-10, Do not lie to one another, seeing that you have put off the old self with its practices and have put on the new self, which is being renewed in knowledge after the image of its creator.

Commit to be honest with one another and pursue God’s plan for your marriage and finances.

If you’re not sure how to take the next steps towards unity and honesty with your spouse, read Money Problems, Marriage Solutions. My wife, Ann, and I wrote this book together after almost 40 years of marriage and decades of mistakes. It’s our hope that this book encourages other couples and helps them avoid some of the mistakes we made in our marriage. You can buy your copy here.

Finding creative ways to increase your income has become an increasingly important step in navigating the workforce and personal finance. It can help you develop and sharpen skills to add value to your current job, and provide financial margin to accomplish future goals, such as saving, investing, and paying off debt.

If you’re looking for some ways to increase your income, here are practical steps to get started. Some of these are supplementary, but there are others that could provide you a full-time salary.

First, have a grateful attitude. Thank the Lord for the opportunity to trust Him during this time. Ask Him to reveal talents or skills He has blessed you with and how you can use them for His glory. Cling to Jeremiah 32:27: Behold, I am the Lord, the God of all flesh. Is anything too hard for me?

Second, answer these questions:

Next, decide what industry you want to focus on. (I do not endorse any of these but simply offer the following resources do your own research before engaging):

There are many business opportunities with daily advances in the technology industries. If you have certain skills there are many freelance opportunities in the tech space to pursue:

With technological advances also comes a desire for more to be “automated” or hands-off, which means many people are willing to pay for daily “lifestyle” services.

Remember, taxes have to be paid on earned income. So, organize your business in order to have everything you need to file early.

I would highly recommend taking the Career Direct Assessment and meeting with a consultant before taking on any extra jobs or changing your current one.

In all your efforts, remember Colossians 3:23-24: “Whatever you do, work heartily, as for the Lord and not for men, knowing that from the Lord you will receive the inheritance as your reward. You are serving the Lord Christ.”

Are you an investor?

The U.S. stock market has grabbed everyone’s attention since volatility began to increase after a full year of uninterrupted growth in 2017. With so many people having some stake in the market, it is no wonder that it has been making the financial headlines lately.

Recent surveys indicate that about 45% of Americans own a mutual fund, 52% say they have investments in stocks, and about 32% invest via a 401(k) through their employer. The average balance for all Americans that have money socked away in a 401(k) is $96,288, though that number varies greatly by age group.

Investing is a great avenue for Christians to increase wealth and potential for the Kingdom of God. Yet so many never start! They are afraid, misinformed, or uninformed altogether and miss out on potential opportunities. More money is not a bad thing, but it is not the source of peace. True peace comes only from God. Peace I leave with you; my peace I give you. I do not give to you as the world gives. Do not let your hearts be troubled and do not be afraid. (John 14:27)

We should distinguish between investment performance and investment purpose. Investment purpose, however is not a matter of skill; it is a matter of intent.

Investing is a great idea for Christians with the right motive and the right approach.

Some of the right motives to start investing are:

The Bible never says that it is wrong to be wealthy or to invest. In fact, the Parable of the Talents is rather “pro-investing”. But the Bible is clear that using any amount of money for the wrong purposes, with the wrong motives is sinful. It also differentiates between gambling and investing.

It is a wrong motive to invest simply for the sake of just making money. Greed or a “get rich quick” motive is condemned in Scripture. Proverbs 21:5 teaches us that, “Steady plodding brings prosperity; hasty speculation brings poverty.” (The recent bitcoin frenzy may be an example of hasty speculation!)

Making money is the byproduct of doing what God has called you to do. We are to make financial decisions as a manager, or steward, of His property, seeking to multiply what He provides to serve Him more fully.

When it comes to investing, the language and the breadth of options can be intimidating, so educate yourself. You can start by learning these 25 vocab words.

And while there are many (maybe an infinite) number of options and combinations and ways you can invest, just start simple. As a beginning investor, you don’t want to get too complicated anyway. Let’s look at 4 main types of investments (none of these include retirement accounts. If you want to learn more about investing for retirement, go here.).

Individual Stocks

An individual stock is a share in a single company. This is probably not the best option for a beginner investor because it takes a lot of knowledge and maintenance. It can be more complicated and volatile than other forms of investments. Buying individual stocks means you run the chance of earning or losing a lot because all your money is riding on a single company.

Bonds

A bond is a loan that you make to the government or corporation and they pay you back with interest. It’s a fairly safe form of investing if you don’t need liquidity (instant access to your money) because your initial investment will grow at the fixed or variable interest rate you agree on. But on the same token, it won’t make you as much money since that interest rate won’t increase.

Equity Mutual Funds

As this blog explains, equity mutual funds are an alternative to individual stocks and bonds, and they are an “easy” way to start investing. A mutual fund works by several people all investing in a portfolio of diversified stocks, bonds, etc. that is managed by a professional.

Let’s say investment X costs $1,000 a share. With a mutual fund, 100 people invest $10 each instead of one person investing $1,000. A professional broker manages the investment, and you’ll typically get a diverse portfolio (meaning your collective investment is put into several different kinds of investments).

Exchange Traded Funds (ETF’s)

ETF’s are like a combination between individual stocks and mutual funds. They are similar to mutual funds because they are made up of lots of other stocks, bonds, or commodities. They are different, however, because they are traded like individual stocks. They tend to have higher liquidity so they appeal to a different kind of investor. When you purchase an ETF, you aren’t actually purchasing the stocks/bonds/commodities that make up the ETF. You are purchasing the share of those stocks/bonds/commodities.

Those are some of the most common, basic forms of investments. I’d encourage you to read more and do your research before actually purchasing anything. Here are some important “do’s” and “don’ts” to follow as you begin this process.

Hopefully this is helpful to you as you consider your future in investing! If you have any advice on how you got started, or have more questions, ask us on Facebook!

I could probably tell you who out of my friend group has an Android phone instead of an iPhone. I have an iPhone so when I text a friend who has an Android, the text message bubbles are green, not blue. In this way, my world is divided – between blue texts and green texts, iPhones and Androids.

But there’s a third party trying to edge its way into this division with a mighty force – flip phones. Now, I know, it seems strange to go backward in technological advances, and on the one hand, it is strange. But making the switch from a smartphone to a flip phone may be the next financial tend.

Billionaire Warren Buffett has publicly stated his commitment to his flip phone. And he’s not the only one! Flip phone sales have increased recently (sales tripled from 2015 to 2016) and it’s not only because of the cost savings.

Just buying a flip phone (not including service) will cost you anywhere from $10-$60, whereas an iPhone would be $350-$1,000. You also have to factor in all the iPhone “accessory” costs, like a case, new headphones, apps, extra cloud storage, and data charges. Many people have started financing and insuring their phones just so they can have the latest version. Clearly, a flip phone will save you hundreds of dollars up front and over the year in service charges.

The extra cash you have in your bank account every month could be spent paying off debt, saving, building a retirement fund, giving generously, and (especially if you’re Warren Buffett), investing. Financial margin is a key to financial freedom, so when you’re looking at what costs you can cut, your smartphone may be a good candidate.

It may help you pursue the command in Hebrews 13:5 to Keep your lives free from the love of money and be content with what you have, because God has said, “Never will I leave you; never will I forsake you.”

There’s another indirect benefit to a flip phone saving you money. Part of the reason many Americans overspend is to “Keep up with the Joneses”. We inundate ourselves with how great other people’s lives are by scrolling through social media feeds for hours a day. This practice can lead to a great deal of unhappiness, anxiety, and comparison. And that comparison not only steals our joy but also a lot of our money. We’re told that for a certain cost, you can look like this, live like this, and feel like this. In order to buy a certain lifestyle or “brand”, many people have gone into overwhelming credit card debt. They now live in bondage to who they follow and the credit card company.

If you, or someone you know, is struggling with overwhelming credit card debt, get in touch with Christian Credit Counselors. And remind yourself of the truths in Scripture:

Colossians 3:2 – Set your minds on things that are above, not on things that are on earth.

Matthew 6:20-21 – …store up for yourselves treasures in heaven, where moths and vermin do not destroy, and where thieves do not break in and steal. For where your treasure is, there your heart will be also.

There’s also another factor at play here. As more and more studies come out about the dangerous, addictive effects screens have on us, there’s an increasing awareness that we need to unplug. Studies have shown a direct correlation between less screen time and increased happiness in teenagers. And there’s no doubt that smartphones decrease productivity in the workplace (costing employers $15.5 billion)

Getting rid of your smartphone may save you hundreds of dollars, but it may also increase your productivity, happiness, and quality of relationships. The inability to check social media, constantly scroll through blogs, and read the latest headlines as they happen may give you more time to read Scripture, read books, and spend time with others.

Of course, there are some negative side effects to getting rid of your smartphone. In many ways, it seems almost unimaginable to go back to living circa 2007 before the iPhone revolutionized our lives. You’d have to have an actual map in your car to get around, listen to the radio or CD’s, and could only check social media from your computer…which is nearly impossible with Instagram.

Technology costs a lot of money, but it can save us a lot of money as well. Budgeting, money management, and an infinite number of financial resources can be accessed via our phones and mobile apps.

The switch to a flip phone may be advantageous in many ways, so take a look at your budget and consider it for yourself. Whatever kind of phone you decide to use, commit to pursuing and living in financial freedom. Crown’s Money Map can help you make and reach your financial goals while you learn biblical truths. When you download the Money Map, you’ll also receive the Money Map Get Started Guide to walk you through each step of the map!

The Focus Toolbox: 11 Tools to Banish Distractions & Become a Better Steward of Your Time

We live in the most distracting time in human history. In fact, experts reported the average human attention span in 2000 was 12 seconds, but in 2015, that dropped to 8 seconds. To add a little perspective, that’s shorter than a goldfish’s attention span. God has entrusted all of us with the wonderful gift of life. As Christians, we are called to live in the constant reminder that our lives don’t really belong to us. They actually belong to God, and it’s up to us make the most of them. That’s what stewardship is all about.

To practice good stewardship in our lives, we need to be good stewards of our time, which means finding a better way to deal with these distractions.

Are you expecting a tax refund soon? If you’re like most Americans, you’re probably expecting somewhere around $3,000 to show up in your mailbox over the next weeks and months. Receiving a refund check has become a strangely normal piece of financial planning for Americans – we count on receiving that extra cash and plan to spend it.

But your refund check is just your own money going back into your pocket. I recommend you adjust your withholdings for the next tax year so you can have more money in your hands every month instead of lending it to the government interest free all year. And if you are planning to receive a refund this year, here are 7 better ways to use it!

Did you know that 70% of Americans don’t have $1,000 saved? In fact, six out of 10 Americans couldn’t even access $500 in an emergency. And 34% of Americans said they don’t have any savings…at all.

Saving is not only critical to getting out of debt and building a stable financial future, it’s an essential part of stewardship. Saving does not represent a lack of faith, it reflects the heart of a faithful steward. Planning to care for your family, disciplining yourself to create financial margin, and balancing your savings are all opportunities to honor God and experience His blessings.

We recommend you make your first savings goal $1,000; then work your way to 3 months’ worth of your living expenses; then 6 months’, and finally 12 (you can track all these goals on Crown’s Money Map). If you’re working to reach any of these savings goals, commit to depositing your refund check directly into your savings account. According to a recent survey, 43% of Americans are planning to do so!

Barely second, 42% of Americans are planning to use their refund to pay off debt. As Proverbs says, the borrower is slave to the lender, so using your refund to pay off debt can help you break the chains of financial bondage and debt.

If you’re specifically dealing with credit card debt too large to be paid off by your refund check, I want you to get in touch with our partners at Christian Credit Counselors. They specialize in helping people pay off their overwhelming credit card debt and can walk you through the process of becoming debt-free.

We also have debt-help resources available for you to create an efficient payoff plan. Go through the 5 Steps to Debt-Free Living video course (it’s free) to get access.

Giving is a material expression of our spiritual obedience to Christ. It’s our way of acknowledging that God is the owner and provider of all we have and that we are His stewards. It’s described in the Bible as a practice that will bring overwhelming blessings and gifts to our lives. Yet we are out of practice and undisciplined when it comes to obeying the Scripture.

Jesus said, “It’s more blessed to give than to receive.” (Acts 20:35)

He also said, “Give, and it will be given to you. A good measure, pressed down, shaken together and running over, will be poured into your lap. For with the measure you use, it will be measured to you.” (Luke 6:38)

Giving requires an emotional sacrifice of forfeiting ownership. It propels us into a freedom found in exercising faith, by believing God will use our gift and supply our need. Be sacrificial and commit your refund check to your church or a reputable ministry that has impacted your life.

Coming in fifth place in TaxSlayer’s survey is saving for retirement. Not saving enough for retirement soon enough is the number one regret of older Americans. As more and more people realize that their dreams of a Floridian retirement are decades of saving short, remember that you are saving to be used by God, not to live a life of leisure.

A detailed, disciplined retirement savings plan is important to have financial freedom. Research what kind of retirement account and investing strategy best suits your age, family, career, and future needs and then be disciplined to save. Adding your entire refund check to your nest egg will help ensure a stable financial future for you and your family so you will be free to be used by God.

If you have at least 3-6 months of your living expenses saved, no debt, a habit of disciplined and generous giving, and a growing retirement account, then consider using your refund check to invest.

The Bible does not condemn investing and Christians should see it as an opportunity to increase their impact for the Kingdom. The stock market’s volatility this year has been in recent headlines, so be cautious and patient to do your research and seek wise counsel. With the right strategy and patient timing, a $3,000 refund check could yield you much greater returns later.

Avoid wasting money on interest on your home’s principal by using your tax refund to prepay your mortgage. Throw a portion of or your entire refund check directly towards your principal balance on your house and shave months off of your loan! (Be sure to specify that you want to pay towards your principal when you make the deposit. Otherwise a large portion could still go to interest payments.)

There are some things that you should spend money on to save money. For example, my wife and I are diligent about keeping our cars well-maintained and routinely spend money to rotate our tires, change our oil on time, and care for our vehicles.

Take care of your home, your vehicles, and your appliances by using your refund check to pay for updates and maintenance. It may not be an exciting use of your money, but it will pay off in the long run.

How are you planning to use your tax refund? Share with us on Facebook!

Feeling anxious about your tax liability as April 15 nears? The Bible has many references to taxes that will sound strangely relevant at this time of year — beginning with the story of David and Goliath.

Many remember a teenage boy offended by insults thrown by a giant foe against his nation and God himself, who volunteers to go into battle with a slingshot. But did you know that a tax incentive was part of his prize?

Visiting the battlefield, David learns: “The king will give great wealth to the man who kills (Goliath) and will exempt his family from taxes in Israel.”

Throughout the Scripture, tax discussions mark many passages, as ancient men and women worried about how they would pay.

In Matthew 17, Jesus noted that rulers often use taxes against people without power. Talking with Simon Peter about a temple tax, Jesus asked, “From whom do the kings of the earth collect duty and taxes — from their own children or from others?”

Peter answered, “From others.”

“Then the children are exempt,” Jesus said. “But so that we may not cause offense, go to the lake and throw out your line. Take the first fish you catch; open its mouth and you will find a four-drachma coin. Take it and give it to them for my tax and yours.”

Behind Crucifixion

Behind CrucifixionAnd yet, when demanding that Jesus be crucified, tax avoidance was levied as an accusation. “We have found this man subverting our nation. He opposes payment of taxes to Caesar and claims to be Messiah, a king.”

For the party in power, tax avoidance might have been the greatest offense.

Even so, the truth remains that a healthy respect for reasonable taxes is part of faith-based culture. Writing in Romans 13, the Apostle Paul urged respect for government because of the vital role leaders play in society, an admonition that goes beyond mere money: “This is also why you pay taxes, for the authorities are God’s servants, who give their full time to governing. Give to everyone what you owe them: If you owe taxes, pay taxes; if revenue, then revenue; if respect, then respect; if honor, then honor.”

Such a standard requires civil interaction and mutual respect, important reminders for today’s toxic political culture. And every IRS agent can take comfort in the fact that Jesus himself had a tax collector (Matthew) as a disciple.

Nonetheless, the growth in tax rates is cause for concern. While a 10% tithe to the church has been the standard for personal giving, today’s combined federal-state bite can reach about 50%. Remember, Pharaoh took only 20% of the grain in Egypt as a form of taxation during their good years. It’s worth debating whether the government should take such a large bite out of families’ resources.

Still, pay your taxes, treat authorities with honor and know that nothing new is under the sun — not even the IRS.

Originally published on USA Today, April 9, 2014

Creativity has never been a more in-demand skill. As automation takes over millions of low-skill, easily repeatable jobs, human creativity is one of the core attributes that differentiates us from machines. Real creativity, the kind that leads to breakthroughs in thinking and design, requires long stretches of deep, uninterrupted concentration.

Multitasking is the biggest threat to real creativity. It makes us less productive, and requires a lot of energy. Even when our multitasking is all related to our jobs, it distracts us from reaching our biggest goals. Therefore, we must abandon multitasking and instead embrace task batching.

Multitasking makes you feel like you’re being productive, but prevents you from completing your most important task. The batch method brings order without forcing us to sacrifice any of our goals. It helps us become better stewards of our time.

Batching requires you to categorize all of your tasks. Then you schedule certain times during the day or week to work on each category. The batch method helps you use your time more effectively than when you’re multitasking. It also fosters peace of mind. When you know you’ve set aside time for answering emails and calls, you won’t stress about getting back to people. The quality of your responses will likely improve as well, since you won’t be rushing to write a reply so you can get back to other work.

To become more productive, try to institute Maker Days and Manager Days, a productivity approach built on batching. All of your meetings, scheduling, phone calls, and other administrative tasks happen on Manager Days. Maker Days are for getting things done.

The Maker vs. Manager model allows you to work effectively and creatively. When everything has an appointed time, nothing falls through the cracks. The quality of your output increases significantly.

Not everyone at your company may be on board right away. When you tell your coworkers, “I won’t be responding to emails this morning,” they might worry that you’re slacking off. But once they realize the opposite is true, they’ll be more forgiving of your slower response times.

Still, shifting from multitasking to batching takes some transitioning. Here’s how to make it easier on your boss, your colleagues, and yourself:

Get Buy-In

Don’t just stop responding to messages, especially in the middle of a big project. Before you switch to task batching, sit down with your boss to explain your rationale and ask for their support and permission. Tell them you’ll be more creative and productive if you’re not constantly reacting to other people’s priorities. If they’re skeptical, ask for a trial period and offer tangible metrics by which they can judge your performance.

Once your boss approves this new approach, huddle with your teammates and let them in on your plans as well. Reassure them that you’re working just as hard as before, if not harder. You simply won’t be available to respond to questions and issues at a moment’s notice. Some of them may even join you on the anti-multitasking train.

Set Expectations

Most conflicts start with mismatched expectations. That is why communication is critical during your batching transition. Share your schedule with your boss and colleagues so they know when you’re available for meetings and when they can expect your input via email or team chat conversations. As they become confident that you’re upholding your responsibilities, they’ll support your new way of getting things done.

Some people will have a harder time than others accepting your changed schedule. Be patient and let your results speak for themselves. If they persist in their criticisms, respond kindly but don’t get distracted from your core goal, which is to do good work. Take comfort in the words of Colossians 3:23, “Whatever you do, work heartily, as for the Lord and not for men.”

Allow Time for Fires

No matter how carefully you plan, emergencies happen. A project goes off the rails, a client pulls out of an agreement, a meeting is poorly run and eats into your day. Avoid falling back into multitasking chaos during these crises by building buffers into your schedule.

Give yourself an extra day or two to finish a project, just in case something comes up. Build in 30 minutes more than you expect to need when making phone calls so you’re not pressed for time if a conversation goes long. Having these bonus productivity slots will help you cement the batch method in your workflow.

Batching requires discipline, and if you’re used to multitasking, self-restraint may be in short supply. But you can build those reserves if you stick to your batching schedule and remember that you’re benefiting yourself, and your company, by doing one thing at a time — and doing it well.

In Ecclesiastes 3, Solomon writes about the time and seasons for everything in life. Verse 1 says, There is a time for everything, and a season for every activity under the heavens. He continues in verses 12 and 13 – I know that there is nothing better for people than to be happy and to do good while they live. That each of them may eat and drink, and find satisfaction in all their toil—this is the gift of God.

I think this wisdom applies to our modern day workplaces. There are times and seasons for certain jobs, certain transitions, and certain tasks within those jobs. But in all of it, we should find joy and satisfaction by doing what God has called us to – by fulfilling our purpose.

If you’re passionate about productivity or simply want to become more efficient, check out our Modern Worker’s Toolkit to Work Smarter, Not Harder.